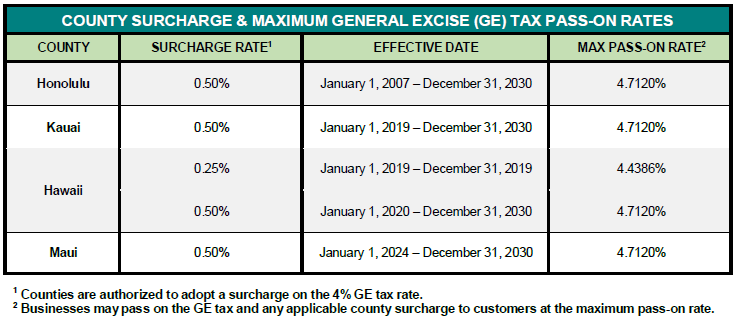

The County of Hawaiʻi will levy a surcharge at the rate of 0.25% from January 1, 2019 through December 31, 2019 and a surcharge at the rate of 0.5% beginning January 1, 2020 through December 31, 2030. The County of Maui has not adopted a surcharge. The county surcharge only applies to transactions subject to the 4.0% GE and use tax rate.

csurchg_2019-2 | Department of Taxation

Feb 27, 2024Several bills designed to ease the state income tax burden on Hawaii residents, including one that would increase the standard income tax deduction, received preliminary approval Tuesday from the

Source Image: khon2.com

Download Image

Jan 29, 2023After a decade in which Honolulu’s property tax collections increased by more than 80% — to $1.51 billion in fiscal 2023 from $834 million in 2014 — city officials in December sent

Source Image: civilbeat.org

Download Image

Gucci Hawaii Pricing Guide (Jan 2022) – The Luxury Lowdown This is THE ultimate guide to Honolulu County Property Taxes for residential properties, covering the current fiscal year, 2023, which runs July 1, 2023 through June 30, 2024. In the following, when we refer to “Honolulu“, it applies to the County of Honolulu – the entire island of Oahu. Besides a detailed overview of the residential property tax rates in Honolulu, you will also find

Source Image: civilbeat.org

Download Image

Did Honolulu Get Tax Increase As Of January 1 2019

This is THE ultimate guide to Honolulu County Property Taxes for residential properties, covering the current fiscal year, 2023, which runs July 1, 2023 through June 30, 2024. In the following, when we refer to “Honolulu“, it applies to the County of Honolulu – the entire island of Oahu. Besides a detailed overview of the residential property tax rates in Honolulu, you will also find Anticipated Rental Motor Vehicle Surcharge Tax rate change to $5/day, effective July 1, 2019: 2019-04: June 7, 2019: Hawaii County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on to Customers, Effective January 1, 2020: 2019-03: June 6, 2019: Revised Hawaii County Fuel Tax Rate, Effective July 1, 2019: 2019-02: April 10, 2019

Green Wants To Make Targeted Changes To Hawaii’s Tax Code. Will The Legislature Go For It? – Honolulu Civil Beat

If the taxes were passed on at the maximum rate of 4.712%, $47.12 would have been collected as tax on the transaction. The GET due would have been $41.89 ($1,047.12 x 4%) and the Hawaii CS due would have been $5.23 ($1,047.12 x 0.5%) for a total of $47.12 due. For general information about GET, see Tax Facts 37-1. If you have any questions PPT – Four Mega Trends PowerPoint Presentation, free download – ID:27709

Source Image: slideserve.com

Download Image

December 21, 2023 The Honorable Ronald D. Kouchi President and Members of the Senate Thirty-Second State Legislature State Capit If the taxes were passed on at the maximum rate of 4.712%, $47.12 would have been collected as tax on the transaction. The GET due would have been $41.89 ($1,047.12 x 4%) and the Hawaii CS due would have been $5.23 ($1,047.12 x 0.5%) for a total of $47.12 due. For general information about GET, see Tax Facts 37-1. If you have any questions

Source Image: capitol.hawaii.gov

Download Image

csurchg_2019-2 | Department of Taxation The County of Hawaiʻi will levy a surcharge at the rate of 0.25% from January 1, 2019 through December 31, 2019 and a surcharge at the rate of 0.5% beginning January 1, 2020 through December 31, 2030. The County of Maui has not adopted a surcharge. The county surcharge only applies to transactions subject to the 4.0% GE and use tax rate.

Source Image: tax.hawaii.gov

Download Image

Gucci Hawaii Pricing Guide (Jan 2022) – The Luxury Lowdown Jan 29, 2023After a decade in which Honolulu’s property tax collections increased by more than 80% — to $1.51 billion in fiscal 2023 from $834 million in 2014 — city officials in December sent

Source Image: theluxurylowdown.com

Download Image

2021-2022 College Catalog by Honolulu Community College – Issuu The Big Island just got a little more expensive, with 2019 ringing in something new — a first-of-its-kind tax that’s expected to cost consumers here $25 million a year. All retail purchases

Source Image: issuu.com

Download Image

County Surcharge on General Excise and Use Tax | Department of Taxation This is THE ultimate guide to Honolulu County Property Taxes for residential properties, covering the current fiscal year, 2023, which runs July 1, 2023 through June 30, 2024. In the following, when we refer to “Honolulu“, it applies to the County of Honolulu – the entire island of Oahu. Besides a detailed overview of the residential property tax rates in Honolulu, you will also find

Source Image: tax.hawaii.gov

Download Image

News and Updates from Pacific Biodiesel – Feb. 2023 – Pacific Biodiesel Anticipated Rental Motor Vehicle Surcharge Tax rate change to $5/day, effective July 1, 2019: 2019-04: June 7, 2019: Hawaii County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on to Customers, Effective January 1, 2020: 2019-03: June 6, 2019: Revised Hawaii County Fuel Tax Rate, Effective July 1, 2019: 2019-02: April 10, 2019

Source Image: biodiesel.com

Download Image

December 21, 2023 The Honorable Ronald D. Kouchi President and Members of the Senate Thirty-Second State Legislature State Capit

News and Updates from Pacific Biodiesel – Feb. 2023 – Pacific Biodiesel Feb 27, 2024Several bills designed to ease the state income tax burden on Hawaii residents, including one that would increase the standard income tax deduction, received preliminary approval Tuesday from the

Gucci Hawaii Pricing Guide (Jan 2022) – The Luxury Lowdown County Surcharge on General Excise and Use Tax | Department of Taxation The Big Island just got a little more expensive, with 2019 ringing in something new — a first-of-its-kind tax that’s expected to cost consumers here $25 million a year. All retail purchases